Unicaja, as part of its current pension plan campaign, offers a bonus of up to 4% for transfers1 from other entities, provided that the customer complies with a commitment of permanence.

Under this campaign, the bank encourages transfers from other financial institutions that are requested until 31 December in Unicaja's network of branches.

Specifically, the cash rebates range from 2% on the balance incorporated (amount transferred over 5,000 euros) to 3% and 4% (in the latter two cases, the contribution must be over 15,000 euros), depending on the permanence commitment acquired: six years for the 2% bonus, seven years for the 3% bonus and eight years to reach the 4% bonus. The maximum incentive per customer will be 4,000 euros.

During that period, the customer undertakes to maintain their position in pension plans marketed by Unicaja.

Wide range of pension plans

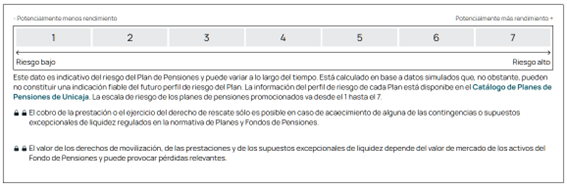

Unicaja has a wide range of pension plans2 to cover any risk profile, from the most conservative Short-Term Fixed Income plans to the most aggressive Variable Income plans, offering alternatives for all participants.

Contributions to pension plans, which also have tax advantages, contribute to the creation of long-term savings, convenient for supplementing retirement pensions.

Thus, with a focus on customer satisfaction, Unicaja, through Unicorp Vida, in which it has a 50% shareholding with Santalucía, manages its assets with a long-term vision, seeking two key objectives: to provide stable returns and preserve capital.

Unicaja’s Life Cycle pension plans adapt their investments to the retirement date of their participants. On the other hand, they allow great flexibility at the time of making contributions, making it possible to make them periodically (monthly, quarterly, half-yearly or annually) or extraordinarily, with a plan suitable for each age or risk profile.

1 Promotion valid until December 31, 2024, limited to a total of €300,000 for transfers of pension plans received, not subsidized in previous campaigns, from another marketing entity. Minimum transfer amount €5,000 to obtain a gross bonus consisting of 2% of the transfer with six years of permanence or €15,000 to obtain a gross bonus of 3% of the transfer with seven years of permanence or a bonus of 4% of the transfer with eight years of permanence. Maximum total bonus per client in all cases of €4,000 gross. Offer cannot be combined with other transfer bonuses. The promotion is subject to the conditions established in the permanence document and to personal income tax in accordance with current tax legislation. The bonus is considered to be capital gains and is subject to withholding tax in accordance with current tax legislation, which is the responsibility of the client and at the rate in force at the time of payment. In the event of non-compliance with the commitment to remain due to the occurrence of any of the conditions detailed below, the client must reimburse Unicaja Banco for the proportional part of the bonus amount received corresponding to the period of time between the date of non-compliance and the date of completion of the commitment to remain acquired as a penalty in favour of Unicaja Banco. The conditions referred to in this section are the following: a) That the participant transfers, in whole or in part, the consolidated rights of any of said plans to another Pension Plan not marketed by Unicaja Banco. b) That the participant/beneficiary redeems, in whole or in part, the consolidated rights of any of said plans due to any of the contingencies or exceptional liquidity situations provided for in the legislation and in the Regulations of the plan.

2 The documents containing the essential data for participants in all the pension plans are available for download and consultation on the following website: https://www.unicajabanco.es/es/particulares/ahorro-e-inversion/planes-de-pensiones/catalogo-de-planes-de-pensiones. The promoting entities are: Unicorp Vida, Cía. de Seguros y Reaseguros, S.A./Unicaja Banco, S.A., and Unión del Duero Compañía de Seguros de Vida, S.A. Managers: Unicorp Vida, Cía. de Seguros y Reaseguros, S.A. and Unión del Duero Compañía de Seguros de Vida, S.A. Custodian: CECABANK, S.A. Marketer: Unimediación S.L.U. through the Unicaja Banco, S.A. network.