-

General Information

- Communication channels with the Company Shares and Capital Share Investor agenda Dividends Merges IPOs and admission of securities Public tender offers Inside Information Other relevant information Relevant Facts until February 8, 2020 Shareholders' agreements Significant holdings and treasury shares

-

Economic and Finantial Information

- Financial reports Half year reports Anual reports Annual Banking Report Annual Corporate Governance Report Annual Remuneration Report Information of Prudential Relevance Information of a public nature sent to bodies other than the CNMV Presentations Ratings AQR and Stress Tests Average payment period to suppliers

- Issuances

- Bonds

DIVIDENDS

You can download the Institution's Dividends Policy from this section.

Dividend proposed by the Board of Directors to the Annual General Meeting of Shareholders 2026

For the year ended on 31 December 2025, the Board of Directors has proposed to the Annual General Meeting of Shareholders 2026 - scheduled to be held on first call on April 9- the distribution of a dividend for a total amount of €443 million, of which €169 million, equivalent to €0.0657 per share, were paid on 25 September 2025 as interim dividends. The remaining amount, totaling €274 million, will be paid as a supplementary dividend for the 2025 financial year, at a rate of €0.10656 gross per share entitled to participate in the distribution at the time of payment (without considering the treasury stock balance on the payment date). The dividend payout ratio will be 70.00% (*).

Payment of the supplementary dividend, once approved by the Annual General Meeting of Shareholders, is expected to be made on April 23, 2026.

Previous years (**)

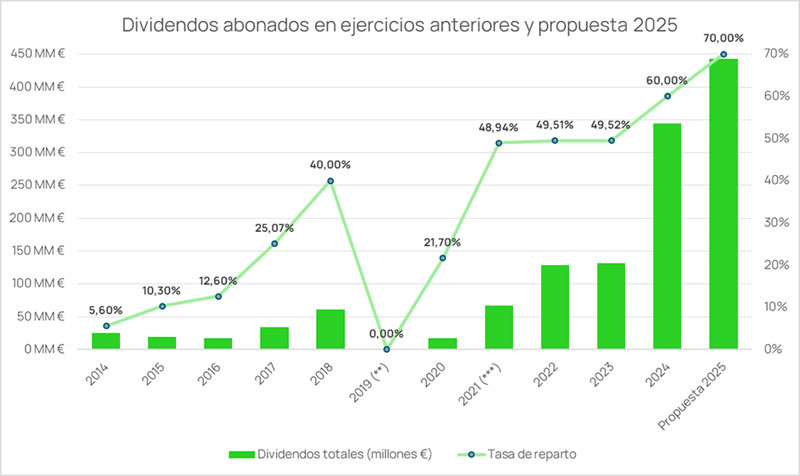

For the years ended on 31 December 2024, 2023, 2022, 2021, 2020, 2018, 2017, 2016, 2015 and 2014, dividends were paid for an amount of €344 million, €132 million, €128.6 million, €67.3 million, €16.9 million, €61 million, €34.6 million, €17 million, €19 million and €25 million respectively, equivalent to €0.134, €0.050, €0.048, €0.025, €0.011, €0.038, €0.021, €0.018, €0.022 and €0.028 per ordinary share respectively, and involving a pay-out ratio of 60.00%, 49.52%, 49.51%, 48.94% (***), 21.7%, 40%, 25.07%, 12.6%, 10.3% and 5.6% respectively. The earnings per share stood at €0.217, €0.098, €0.095, €0.544, €0.045, €0.095, €0.113, €0.154, €0.202 and €0.532 for the years ended on 31 December 2024, 2023, 2022, 2021, 2020, 2018, 2017, 2016, 2015 and 2014 respectively.

Dividends paid out in previous year and proposal for 2025

Additional information on dividends

Dividends shall be paid in euros. In accordance with the Law on Corporate Enterprises (Ley de Sociedades), dividends will be declared and paid out pro-rata according to the number of ordinary shares held by each shareholder of the Company. The declared dividends but not yet accrued shall not produce interest.

In accordance with the current tax regulations, paid dividends shall be subject to the tax withholding applicable in Spain.

(*) Earnings per share have been determined by dividing net profit for the year attributable to the Bank by the weighed average number of outstanding shares during the year, excluding the average number of own shares held during the year.

(**) For the year ended on 31 December 2019, it has to be noted that on 27 March 2020, the European Central Bank (ECB), in the context of the crisis caused by the COVID-19, issued a recommendation to all the supervised financial institutions on the restriction, at least until 1 October 2020, on the payment of dividends and share buy-backs, in order to reinforce the solvency of banks and to promote their role as key players in the recovery of the economy, facilitating lending, in coordination with the measures promoted by the governments. On 27 July 2020, the European Central Bank issued a new Recommendation where it considered it necessary to extend the recommendation not to pay dividends until 1 January 2021 and not to undertake irrevocable commitment to pay out dividends for the financial years 2019 and 2020. Following the said European Central Bank’s Recommendations, the Company’s General Meeting of Shareholders held on 28 October 2020 resolved to allocate to voluntary reserves the amount of €77,525,284.50 which was initially to be allocated to dividends.

(***) For the sole purpose of comparison with previous years, the consolidated net income for 2021 has been calculated based on pro-forma data and excluding extraordinary adjustments for the impact of badwill due to the integration of Liberbank and labor and commercial network restructuring costs. Excluding these amounts, the pay-out ratio would amount to 6.05%.