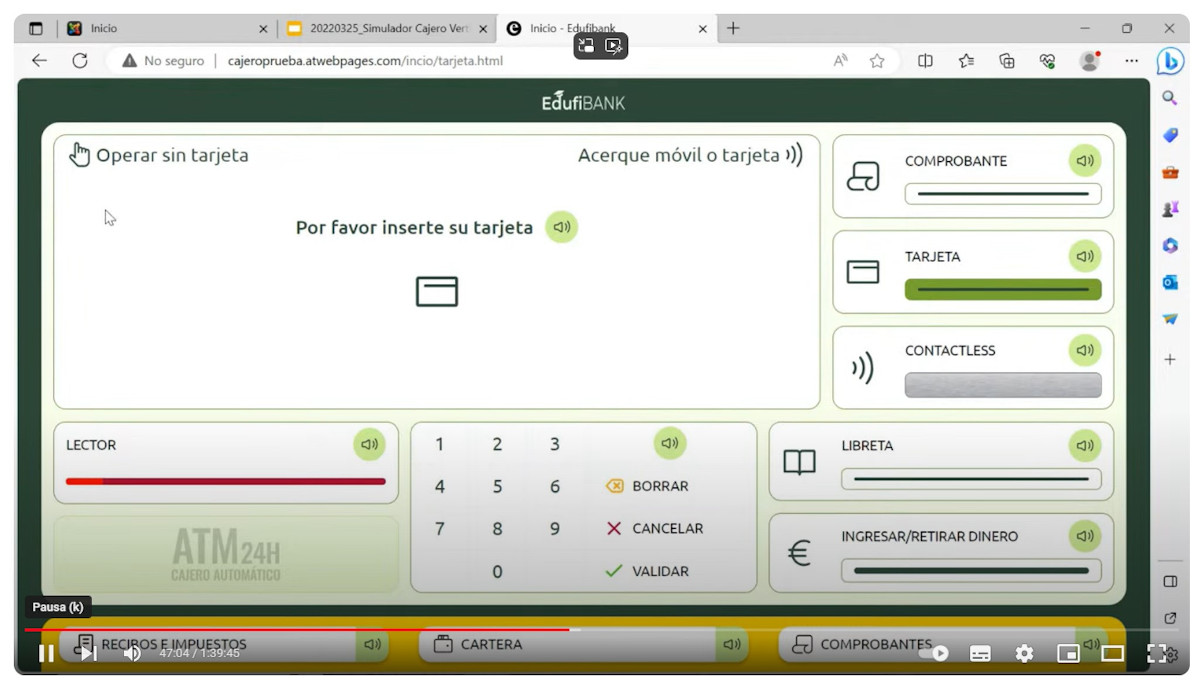

The Edufinet Project, a financial education program promoted by Unicaja and Fundación Unicaja, has presented its own ATM and banking app simulators, developed with the collaboration of Funcas Educa.

The design of these simulators, based on real devices under the generic brand 'EdufiBank', responds to Edufinet's commitment and firm commitment to strengthen training in financial and digital education for people over 60, as well as other groups, making available to them new teaching and support resources in the development of the workshops that the program provides specifically to these demographics, with the aim of promoting their financial inclusion and reducing the digital divide.

These technological applications have been progressively incorporated into the educational program of these sessions, so that their beneficiaries can improve their skills in handling digital banking, as well as put into practice all the knowledge acquired in a simulated digital environment, which they access through the use of tablets and with the support of their trainers. All this, from an eminently practical and didactic approach, with accessible and intuitive contents, which reproduce in a real way and offer a complete vision of the functions of these banking services, facilitating their understanding and implementation at all times.

Through these simulators, users can learn how to carry out, step by step, the most common operations performed at an ATM, such as withdrawing and depositing cash, making transfers and paying bills and taxes, as well as collecting their pension or topping up their cell phones. They will also become familiar with the operations and services offered by a banking app. In this way, they will be able to check their balance and account movements, sign up for cards and other savings and investment products (deposits or funds), manage their direct debits and notifications, or transfer money directly or through Bizum.

The presentation of these tools is part of the set of actions developed by Edufinet, on the occasion of Financial Education Day, on 7 October. This initiative, driven by the Financial Education Plan (PEF), is promoted by the Bank of Spain, the National Securities Market Commission (CNMV) and the Ministry of Economy, Trade and Enterprise.

Senior citizens: a priority group

During this time, the Edufinet Project, which will celebrate its 20th anniversary in 2025, has worked to bring financial education closer to society as a whole, with special attention to the most vulnerable or less skilled groups, in order to ensure that they make the right decisions in the field of economy and finance. In this sense, senior citizens are a priority group of interest within its educational program, as evidenced by the implementation over time of various educational activities, both in person and online, aimed at adults in general and the senior segment in particular, which are held throughout the year.

The workshops for senior citizens and, specifically, the 'Ambassadors Project' are part of this set of actions, which aim to respond to and support the need for greater financial and digital training and inclusion of this group. In short, the aim is to broaden their knowledge in economics and finance, in addition to favoring their transition to the new digital and technological framework and informing them about cybersecurity.

To this end, Edufinet's team of professionals provides them with key basic concepts of financial education, in a practical and simple way, so that they can manage their personal finances with greater autonomy, and helps them to improve their skills in handling digital banking in its different media. It also informs them of the challenges and threats posed by this new scenario, providing useful tips to help them detect and protect themselves against possible fraud and cyber risks in various channels and contexts, as well as in online transactions.

Specifically, during the 2023-2024 academic year, a total of 6,144 people benefited from both these workshops and the 'Ambassadors Project (Financial Education for Senior Citizens)', in the form of 168 classroom sessions, with more than 300 hours of training, which were given by 15 trainers. In addition, there were 11,421 views in 20 online sessions, in which a total of 483 seniors registered. The Edufinet Project's financial education program for senior citizens was recently recognized with the Finance for All 2024 Award, granted by the Financial Education Plan, in the category of best financial education initiative developed by non-collaborators.

Edufinet Project, a pioneering initiative

The Edufinet Project, with almost two decades of experience, is one of the pioneering financial education programs in Spain. It currently has the collaboration of a dozen institutions and business organizations, as well as 17 universities.

Its website (www.edufinet.com) offers practical and educational information on the financial world through different sections (Edufinext, Edufiemp, Edufitech, Edufiblog, Edufisport, Edufiagro and Edufiacademics). Other lines of action include courses and conferences (in-person and online) and publications, in addition to the educational work carried out through its social media profiles (YouTube, Facebook, X, LinkedIn, Instagram and TikTok), and the podcast platforms iVoox and Spotify.