Unicaja reinforces its commitment to customers over 60 years* of age with the launch of its new range of life annuity insurance1, financial products that guarantee the collection of a monthly and constant income for life, with high profitability2 and preferential taxation3.

Designed to supplement the retirement pension or provide a stable income regardless of market fluctuations, these insurances represent an effective solution for financial planning in retirement.

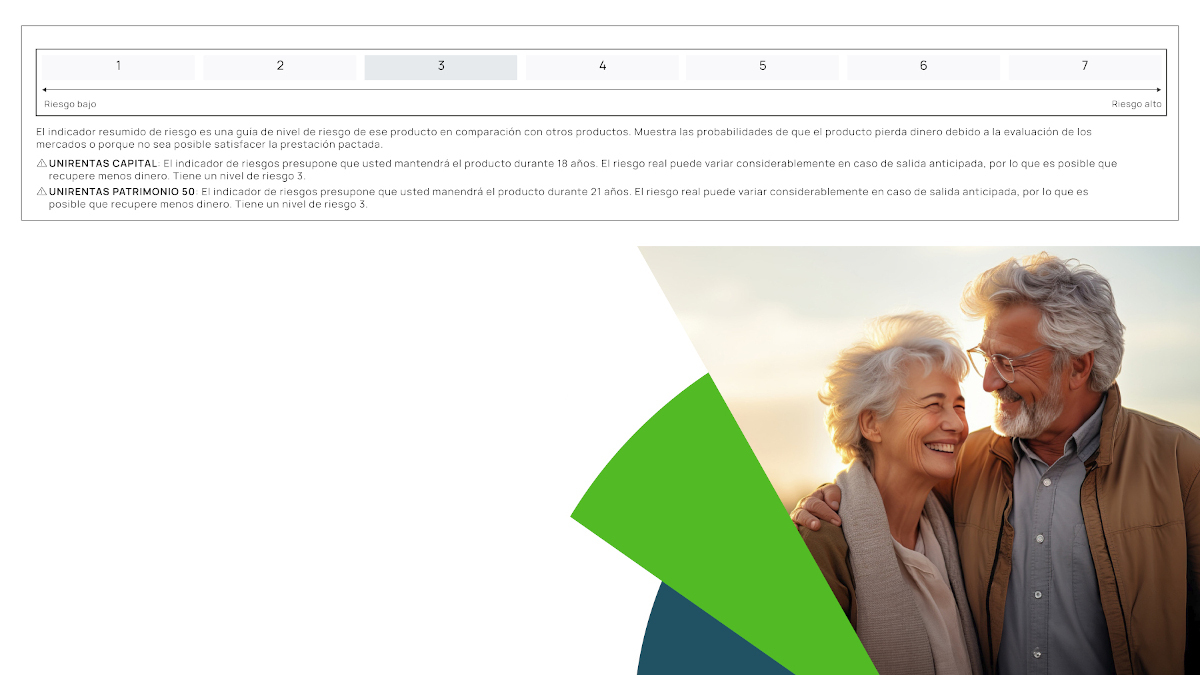

Specifically, Unicaja has two live annuity products:

- Unirentas Capital guarantees that, in the event of the insured's death, the beneficiary will receive 101% of the premium invested.

- Unirentas Patrimonio 50 guarantees a capital decreasing by 5% annually during the first ten years, until 50% of the single premium invested is reached, at which time the guaranteed capital remains fixed.

Tax advantages

One of the main benefits of these products is their favorable tax treatment. Depending on the age of the insured person at the time of taking out the annuity, only a portion of the annuity is subject to personal income tax (IRPF).

Thus, between 60 and 65 years of age, 24% of the annual income received will be taxed; between 66 and 69 years of age, 20%, and from 70 years of age, only 8%.

In addition, people over 65 years of age who reinvest the amount of a transfer of assets in a life annuity are exempt from paying income tax on the gain obtained in the IRPF. To obtain this exemption, the type of annuity to be taken out is Renta Patrimonio 50, with a maximum reinvestment amount of 240,000 euros and within six months after the transfer of assets.

Life annuities also allow for efficient estate planning, as they are not part of the estate and allow the insured person to freely designate beneficiaries, with the possibility of modifying them at any time.

Unicaja's value proposition is extended with life annuities. This proposition includes a wide range of insurance products aimed at protecting the health, home, vehicle and savings of its customers, with complete coverage and favorable conditions for each stage of life.

This is a complex product that may be difficult to understand.

The policyholder assumes the full investment risk, which may affect the payment of Survival and Death benefits, as well as the surrender value. It is not advisable to invest in this product with the intention of surrendering it early, as doing so may result in significant losses compared to the initial investment.

This product does not aim to, nor does it promote, sustainable characteristics (Articles 8 and 9 of Regulation 2019/2088).

Maximum contracting age: 85 years.

1Insurance policies contracted with Unicorp Vida Compañía de Seguros y Reaseguros S.A. through Unimediación S.L.U., a tied bancassurance operator registered in the Special Administrative Register of Insurance Distributors of the Directorate-General for Insurance and Pension Funds under registration number OV-0010, operating through the Unicaja Banco, S.A. network. Civil liability insurance has been arranged in accordance with current legislation. You can consult the list of insurance companies with which Unimediación S.L.U. has an agency agreement at www.unicajabanco.es/seguros.

2he insurance company will not guarantee any type of interest in the event of insolvency of the Spanish State (including the State, Autonomous Communities, and/or guaranteed public entities) or of other Member States of the European Union, in accordance with the provisions set out in the general terms and conditions.

3This feature is based on current tax regulations. Future changes to such regulations may alter this characteristic.