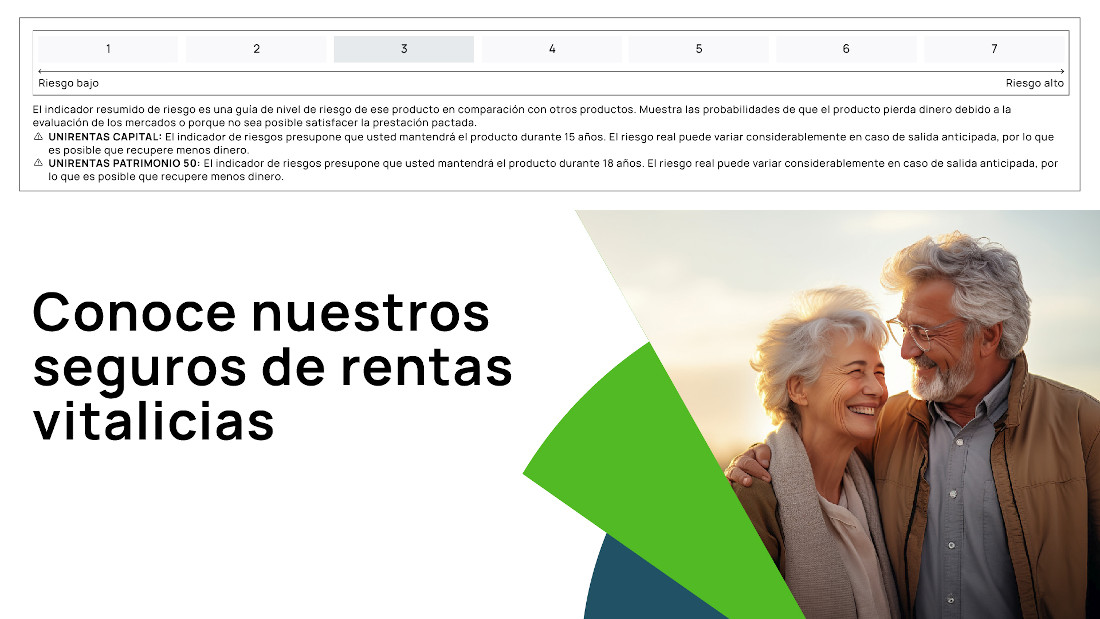

In its aim to adapt its offering to the financial needs of its customers, Unicaja offers an attractive range of life annuity insurance policies for the over-60s, which will allow them to plan their monthly income and invest safely and easily throughout their lives, at a technical interest rate depending on the issue.

In this sense, the bank offers two savings and investment modalities to accompany this demographic during their life cycle: Unirentas Capital and Unirentas Patrimonio 50, both from Unicorp Vida, a company 50% owned by Santalucía and Unicaja. With these financial solutions, policyholders are guaranteed, by means of a single minimum initial contribution of 20,000 euros, the reception of a constant and invariable monthly life annuity, immediately, from the first month.

Thus, customers between the ages of 60 and 85 can benefit from the advantages derived from these products which, in addition to meeting the financial requirements most in demand by this group, allow them to receive a fixed monthly amount, which remains unchanged in the face of interest rate and market fluctuations, from the time they are taken out until their death.

Another special feature of these insurance policies is that, since they do not form part of the estate, the insured person decides at all times how to bequeath part of his or her assets, and may designate the persons he or she wishes as heirs to the capital invested.

The amount received in the event of death depends on the modality subscribed. On the one hand, with Unirentas Capital, the beneficiaries designated in the event of death can receive an additional capital, which is 101% of the premium invested by the insured person.

In the Unirentas Patrimonio 50 alternative, the sum insured in the event of death decreases by 5% each year of the policy term, up to a minimum limit of 50% of the premium paid.

High profitability products with tax advantages

Another important feature of these products are their preferential conditions in tax matters, since the income generated from the single premium has important exemptions on the income from movable capital. Therefore, the beneficiary will be taxed in the IRPF a reduced percentage of the annual income received, which varies according to the natural age of the insured person at the time of subscription, so that this turns the life annuity into an investment vehicle with a high profitability.

Specifically, users aged 70 and over are only taxed on 8% of the monthly income received, while those between 66 and 69 years old are taxed on 20%, and those between 60 and 65 years old are taxed on 24%.

Likewise, in the case of persons over 65 years of age, gains obtained from the transfer of assets may also be excluded from this tax, provided that the total amount is destined, within a period of six months, to constitute an annuity insurance in their favor, specifically, in the Unirentas Patrimonio 50 modality. In this case, the maximum amount that may be allocated is 240,000 euros. When the amount allocated to this insurance is less than the total capital gain received, only the proportional part corresponding to the amount reinvested will be excluded from taxation.

Insurance contracted with Unicorp Vida Cia. de Seguros y Reaseguros S.A. through Unimediación S.L.U., a linked banking-insurance operator, registered in the Special Administrative Registry of Insurance Distributors of the General Directorate of Insurance and Pension Funds with registration number OV-0010, acting through the Unicaja Banco network, S.A. Arranged civil liability insurance in accordance with current legislation. You can consult the insurance companies with which Unimediación S.L.U. has an agency contract signed at www.unicajabanco.es/seguros

(1) It is not advisable to invest in this product with the intention of redeeming it. Doing so may involve significant losses compared to the initial investment.

(2) The insurance entity will not guarantee any type of interest in the event of the insolvency of the Spanish State (State, Autonomous Communities and/or endorsed public entities) or other Member States of the European Union, in accordance with the provisions established in the general conditions.

(3) Circumstance based on current taxation. Future modifications may alter this feature.