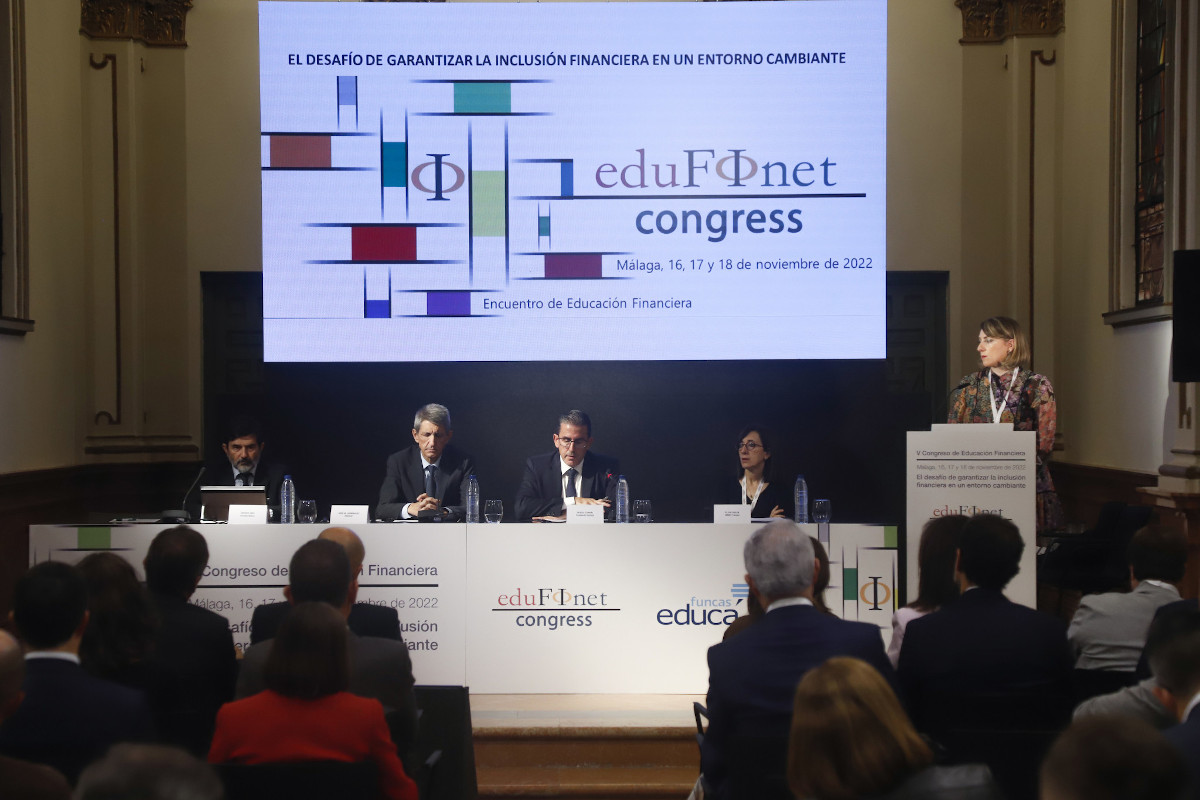

Some 50 experts from different fields are meeting from Wednesday, 16 November, until Friday 18 at the 5th Financial Education Congress, organized in Malaga by Unicaja’s Edufinet Project and whose central theme is financial inclusion.

This new edition, sponsored by Funcas Educa, is entitled ‘The challenge of ensuring financial inclusion in a changing environment’ and is divided into 13 sessions and six round tables.

The congress can be followed both in person, at the Centro Cultural Fundación Unicaja de Málaga (Palacio Episcopal), and online, through the Edufinet Congress website, where it is also possible to register for free.

The opening ceremony on Wednesday has been attended by the Head of the Edufinet Project, José M. Domínguez; the Head of Social Studies at Funcas, Elisa Chuliá; the General Manager of Fundación Unicaja, Sergio Corral, and the Director General of General and Technical Secretariat of Unicaja Banco, Vicente Orti.

In the different sessions and round tables, the participants will emphasize the need for everyone to have access to quality financial products and services, bearing in mind the current technological development.

Financial education can be a strategic tool in facilitating inclusion, as a better understanding of financial concepts and products will enable citizens to be more aware of risks and opportunities and, in short, to make informed decisions.

Speakers and topics

Regarding the speakers, the congress has representatives from the National Securities Market Commission (CNMV), CECA, Funcas, Instituto Español de Analistas Financieros (IEAF), Analistas Económicos de Andalucía, Spanish Data Protection Agency (Agencia Española de Protección de Datos, AEPD), Academia de Ciencias Sociales y del Medio Ambiente de Andalucía, Fundación Caja Extremadura, Cruz Roja de Extremadura, Locos de Wall Street, SECOT, European Center for Innovation and Entrepreneurship (ECIE), Instituto Santalucía, Club Unicaja Baloncesto, Atletismo Jaén or Malaga Smart City Cluster.

Speakers from universities such as those of Malaga, Granada, Huelva or Seville, UNED or Complutense and Universidad Autónoma de Madrid, as well as associations from different fields will also be participate in the congress.

The congress will address issues such as challenges and trends in the field of financial education, as well as its use as a means to prevent social exclusion. Along these lines, there will also be discussions on access to financial services by senior citizens, or financial education in the world of sports, as well as the importance of sustainable finance.

Financial consumer protection; inflation and its impact on economic and financial decision-making; specific products such as pension plans, or financial education and its relationship with taxation, investment, entrepreneurship, artificial intelligence or cryptocurrencies, are other topcis to be covered.

In general, Edufinet’s objective with the organization of this congress is to continue offering a meeting point for the different agents involved or interested in financial education; to analyze the current situation in order to identify trends and points of interest, and to share knowledge and experiences.

Likewise, it seeks to identify the main challenges currently posed by financial and digital education in relation to improving the culture in this area from a general perspective, but also with vulnerable groups in mind.