Unicaja Banco’s ‘Servicio Nómina’ allows its customers to enjoy the ‘Zero Fees Plan’, to have an advance of up to 500 euros of their salary available on their account with no fees or commissions, to receive an advance of up to three salaries, to get discounts of up to 20% on life and home insurances not related to mortgage loans, and better access conditions to loans, deposits and mortgages.

Furthermore, requirements to access this promotion are made more flexible for the young people, aged 18-27, so as to enhance the support to this group.

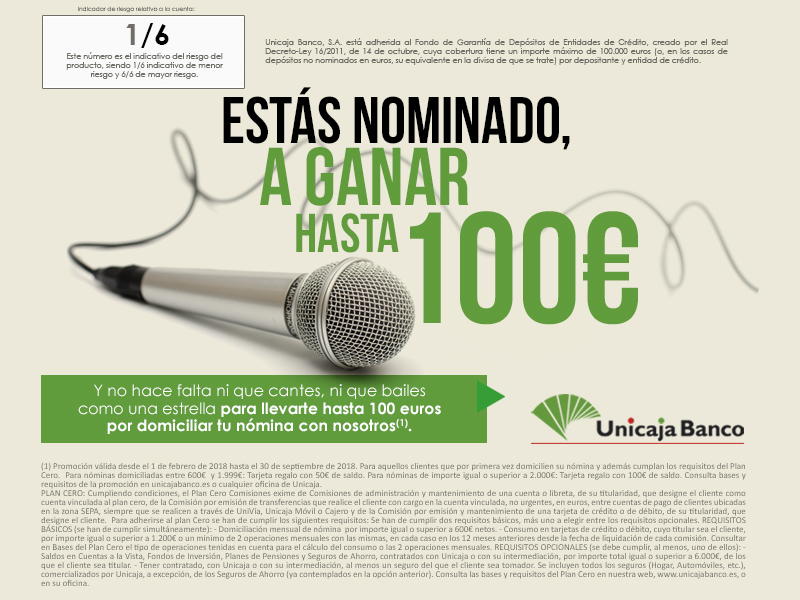

Unicaja Banco ha lanzado una nueva campaña promocional del Servicio Nómina, que permitirá disfrutar de numerosas ventajas exclusivas a aquellos clientes que domicilien su nómina por primera vez antes del 30 de septiembre en cualquiera de las oficinas de la entidad financiera, como disfrutar de una tarjeta regalo con hasta 100 euros de saldo.

Unicaja Banco has launched a new marketing campaign of its ‘Servicio Nómina’ (Salary Service), which includes exclusive advantages for those customers who sign up for the first time for the direct deposit of their salary. The campaign will be in force until 30 September and is available at all the branches. The advantages include a gift card with up to 100 euros.

Other advantages of the ‘Servicio Nómina’ include the possibility to have an advance of up to 500 euros of their salary available on their account with no fees or commissions, to get discounts of up to 10% in life insurances and of up to 20% in home insurances, provided that these are not related to mortgage loans; no fees for credit cards during the first year, better access conditions to loans, deposits and ‘Fidelidad’ mortgage, or to enjoy the ‘Zero Fees Plan’, by which customers are waived of commissions in the most usual transactions.

Furthermore, Unicaja Banco makes it easier for young people to access to this promotion. In this sense, the requirements for this group (people aged 18-27) are made more flexible.

The promotion ‘Amigo trae amigo’ (Friend brings friend) is also included in this campaign. This promotion allows people under the age of 28 and which benefited from the promotion last year to get another gift card, if they bring a relative or a friend under that age and which signs up for the direct deposit of his/her salary for the first time and qualify for this campaign.

The advantages offered for this population group fall within the actions of EspacioJovenUni, Unicaja Banco’s platform for the youth on www.espaciojovenuni.com, which includes among its goals employment promotion, entrepreneurship, training, innovation and talent. It also offers exclusive advantages through actions of institutional and business collaboration to favour social and economic development.